Child Tax Credit 2024 Eligibility Requirements Amount – You may be eligible for a child tax credit payment — in addition to the federal amount — if you live in one of these states. . For 2023 tax year, the maximum tax credit available per child is $2,000 for each child under 17 under Dec. 31, 2023, CNET reported. If you are eligible, it could reduce how much you owe in taxes but, .

Child Tax Credit 2024 Eligibility Requirements Amount

Source : kvguruji.com

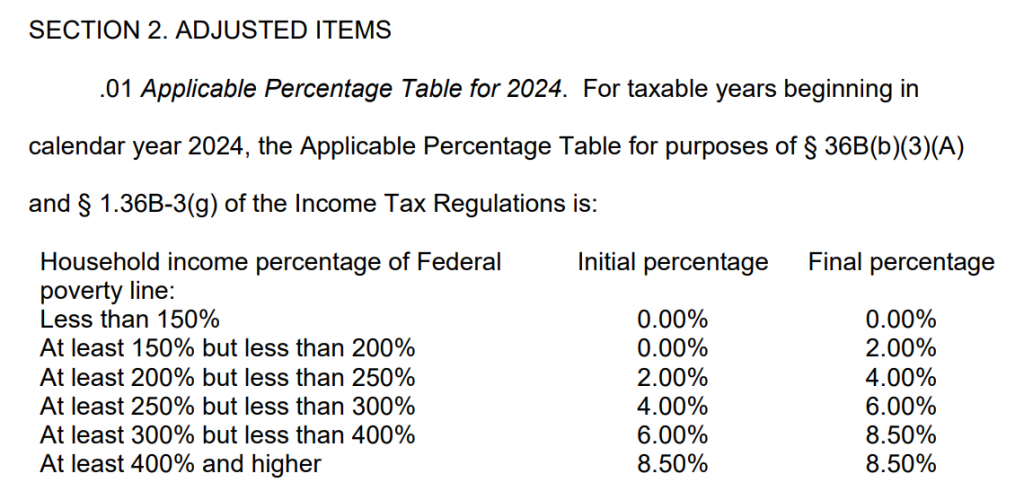

IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA

Source : www.cpapracticeadvisor.com

Earned Income Tax Credit 2024 Eligibility, Amount & How to claim

Source : www.bscnursing2022.com

Child Tax Credit 2024 Apply Online, Eligibility Criteria

Source : matricbseb.com

Child Tax Credit Amount 2024 Eligibility, Claiming Deadline, How

Source : ncblpc.org

Child Tax Credit 2024: How Much You Could Get and Who’s Eligible

Source : www.cnet.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Tesla Model 3 RWD and Long Range tax credits reduced for 2024

Source : www.teslarati.com

Child Tax Credit 2024 Eligibility Requirements Amount IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return: Congress is hashing out a deal to improve the Child Tax Credit, possibly before the start of tax season. For now, these are the eligibility limits in 2024. . Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how many children they have. .